Why pay for A-Z when you only drive from A-B?

Introducing connected Pay-per-KM Insurance.

SEE HOW IT WORKS

We’re putting you in control with insurance that connects to your car, so you pay for the insurance you use.

KOBA works by connecting your car’s onboard computer to our app, securely measuring the KM you drive.

Our pay-as-you-drive model means your bill may change depending on how much you travel.

Driving less? You’ll pay less.

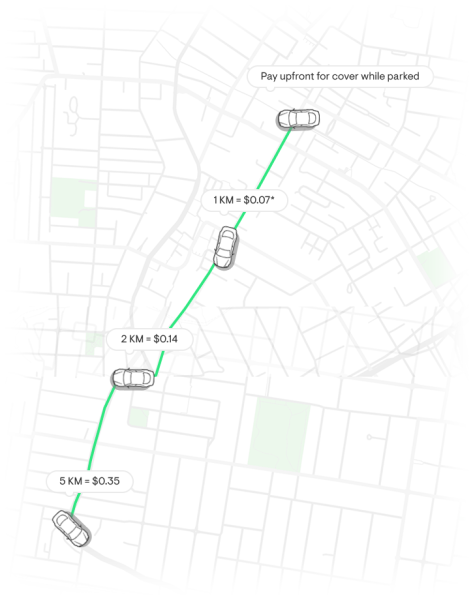

Get comprehensive car insurance with a transparent cost that’s split into two: a cost for coverage while parked and a cost per KM you drive.

1/ Coverage while parked

Pay an upfront fixed cost that covers your car while it's parked from things like fire, theft and hail for example.

2/ Coverage while driving

Pay from a few cents per KM you drive. This cost is calculated at the end of each month and is your per-KM rate multiplied by the number of KM you’ve driven.

Unexpected long trip?

Our Capped price promise means if you occasionally drive more than 250KM/day or 1750 KM/month, the rest of the KM that day, or billing month, are on us^!

Joining us is easy

1/ Switch to KOBA

Your car is covered by an upfront fixed cost while parked and a unique cents-per-KM rate while driving.

2/ Activate your

KOBA Rider

We send you a KOBA Rider in the post to count the number of KM you drive. This easily plugs in under your car’s dash and syncs with our app.

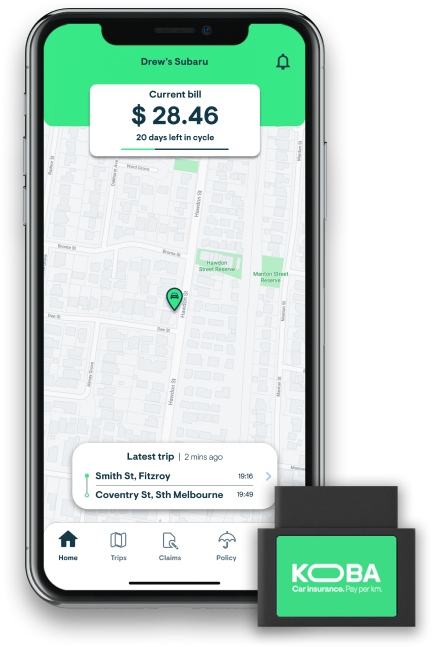

3/ See Trips & Costs almost instantly

Start driving. We’ve got you covered from your policy start-date. See trips, costs to insure and policy info on our app.

WE’RE CHANGING THE TYPICAL INSURANCE MODEL

How KOBA Compares

Terms, conditions, limits and exclusions apply. For full details, please read our Product Disclosure Statement.

Our inclusions

Get comprehensive cover that covers your car and damage you might cause to other people’s property. Pay from a few cents per kilometre you drive and an upfront fixed cost to cover you while parked

Cost of repairing or replacing your car should loss or damage occur due to an incident such as collision, theft, vandalism, storm, hail, flood or fire for example.

Up to $20m legal liability cover for damage your car might cause to other people’s vehicles or property.

A lifetime guarantee on repairs that we authorise under a claim for as long as you own the car.

If your car is written off in the first 24 months of its registration and has less than 40,000KM on the odometer, we’ll replace it with a new one.

Reasonable costs of towing and storage following an incident we cover.

We’ll reimburse costs for a hire car or alternative transport if your car is stolen, up to $70 per day for a maximum of 14 days.

You can choose an Agreed value for your car so you always know what your car is covered for.

You don’t need to list all of your car’s accessories and options with KOBA. They’re covered as part of your car. Please note there are some modifications that we do not cover and we’ll let you know about these when you get a quote or buy a policy.

We pay for damage to baby seats as a result of a claim up to $500 per item and a maximum of $1,000 in total.

Up to $500 for your accommodation and emergency travel if you are more than 200 kilometres from home and your car cannot be driven.

Optional cover for an extra premium

If your car is being repaired as a result of an incident other than theft, we’ll reimburse you for the costs of any hire car or alternative transport during that time up to $70 a day for a maximum of 14 days.

You won’t pay an excess if you make a claim for damage that only affects your windscreen, sunroof or window glass and no other parts of your car.

HOW IT WORKS

Introducing the KOBA Rider

When you join, we’ll send you a small KOBA Rider device that easily plugs into your car.

This securely measures your KM and powers our app. Once you log in, you’ll be able to see trips, costs and policy info almost instantly.

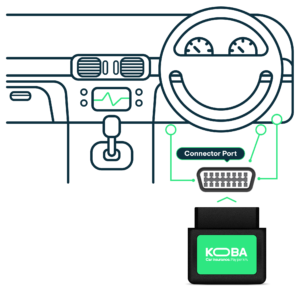

CONNECTING THE KOBA RIDER

How do I plug it into my car?

Once you receive the KOBA Rider, it’s simple to plug in.

Every car will be slightly different, but the plug you’re looking for is the OBD-II port. This will be on the driver’s side; either somewhere under the dashboard or near the steering wheel.

The OBD-II connector port has a 16-pin port that your KOBA Rider plugs into, just like any other socket. All cars manufactured after 2006 have an OBD-II port installed.

Once plugged in, you’ll see a light appear which means you’re connected.

Download the app & start driving. We’ve got you covered from your policy start-date. Securely access your trips, costs and policy docs almost instantly.

Want more KOBA Rider FAQs?